Renewable Energy

Since the industry's early days. Solar, storage, fuel cells, hydrogen—one of only a handful of U.S. brokers with Energy Savings Warranty products.

Nationally recognized insurance advisor specializing in renewable energy, cannabis, and construction. 25+ years helping businesses navigate complex risk.

When Sacramento dispensaries needed coverage in 2008, most brokers said no. Doug said yes. That willingness to understand emerging industries before they go mainstream has defined 25+ years of his career.

Since the industry's early days. Solar, storage, fuel cells, hydrogen—one of only a handful of U.S. brokers with Energy Savings Warranty products.

Since 2008—years before legalization. Cultivators to dispensaries, full regulatory knowledge from 15+ years in the space.

25+ years serving California. Developers, GCs, and specialty trades—solar installers, HVAC, plumbing, roofing.

831(b) micro captives and self-insured groups. Sophisticated structures for companies ready to control their costs.

Shaping policy, educating industries, and sharing expertise where it matters.

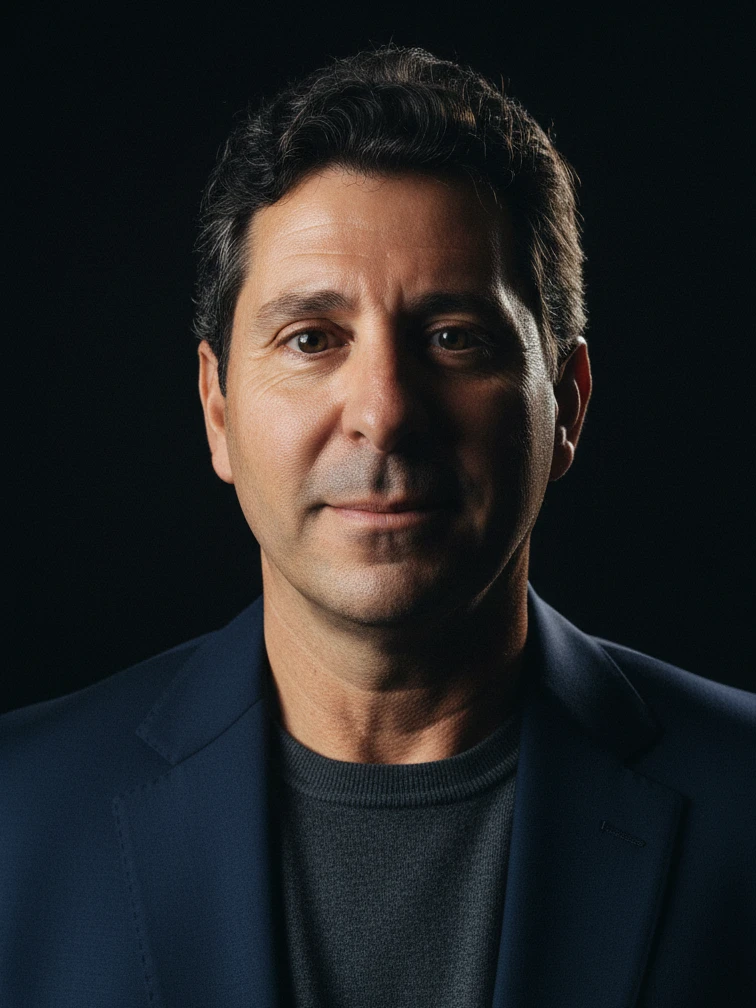

Doug Esposito has spent over 25 years in the insurance industry with a simple philosophy: treat every client's business as if it were his own.

His career began after leadership roles with a San Francisco general contractor—giving him firsthand understanding of the industries he now serves. He joined Owen-Dunn Insurance Services in 2002, building their energy, construction, and cannabis practices from the ground up. When Owen-Dunn joined AssuredPartners in 2017 (now part of Gallagher), Doug continued leading these specialized divisions with the resources of one of the nation's largest brokerages.

Before insurance, Doug worked as a "Bookman" for the Southwestern Company, selling educational books door-to-door across Arkansas, Southern Illinois, and Missouri—an experience that instilled the work ethic and people skills that define his approach today.

"I treat every client's business as if it were my own."

Whether you're in renewable energy, cannabis, or construction—I'd welcome the opportunity to discuss your coverage.

Common questions about working with a specialized insurance advisor.

I specialize in renewable energy (solar, battery storage, fuel cells, hydrogen), cannabis and hemp operations, construction trades, and alternative risk solutions including captive insurance programs. These are industries where standard coverage often falls short, and specialized knowledge makes a significant difference in both coverage quality and cost.

Specialized brokers have deep relationships with the carriers who actually write coverage for your industry. We understand the specific risks you face, speak your industry's language, and know which policy endorsements you need. A generalist might get you a policy, but a specialist ensures you're actually protected when something goes wrong.

Yes—this is actually a significant part of what I do. Many businesses in emerging industries or with complex risk profiles get declined by standard carriers. I have relationships with specialty markets and surplus lines carriers who are comfortable with risks that others won't touch. If you've been told your business is "uninsurable," let's talk.

An agent typically represents one or a few insurance companies and sells their products. A broker represents you, the client, and shops your coverage across many carriers to find the best fit. As a broker, my obligation is to you—finding the right coverage at competitive rates—not to any particular insurance company.

Cannabis insurance requires carriers who understand the unique regulatory environment and are comfortable with the federal-state legal tensions. I work with admitted and non-admitted carriers who specialize in this space, covering everything from product liability to crop coverage to regulatory defense. The process starts with understanding your specific operation and license type.

A captive is essentially your own insurance company, formed to insure risks of your business or a group of related businesses. It allows you to retain underwriting profits, customize coverage, and potentially access reinsurance markets. Captives work best for established businesses with predictable loss histories who are frustrated with traditional market volatility.

I work with businesses ranging from startups to large commercial operations. For specialized industries like cannabis or renewable energy, I'll work with companies at almost any stage—getting the right coverage early prevents problems later. For captive programs, we typically need businesses with at least $150,000 in annual premium spend to make the economics work.

The best way to start is a conversation. Reach out via email or phone, and we'll schedule a time to discuss your business, current coverage, and any concerns you have. I'll review your existing policies and identify any gaps or opportunities. There's no cost or obligation for an initial consultation.